The information contained in this article pertains to transfer changes made effective in 2019.

The Post-9/11 GI Bill is one of the most valuable veterans benefits. Being able to transfer your GI Bill to your spouse or children makes it even more valuable. But there are changes on the horizon that might impact how much those benefits will be worth if you do transfer them.

Here is the main takeaway from this article: If you are able to transfer your Post-9/11 GI Bill benefits, do it now. Several changes have already been made to GI Bill transfer rules, including stricter limitations on those who are eligible to transfer the BI Gill to their dependents. More changes are likely to happen in the future.

OK, now let’s talk about why.

The Post-9/11 GI Bill was Created as a Retention Tool

The Post-9/11 GI Bill was designed as a retention tool for military members in the early years of the post-9/11 era. When it was created, the military was struggling to maintain its end strength. The new GI Bill was a carrot dangled in front of troops — serve a few more years, and you will be eligible for an enormously valuable benefit.

In 2009, the deal became even sweeter. Service members were able to transfer their Post-9/11 GI Bill benefits to their spouses or children in exchange for agreeing to serve more time on active duty. This was unprecedented, as virtually no other veterans benefits are transferable to the spouse and children (with the exception of some benefits that transfer posthumously).

Retention is not a problem now. Congress is looking for ways to cut costs, including a large reduction in force (RIF). This may impact the value of the benefit you transfer, unless you have already done it or you do it soon.

Post-9/11 GI Bill Transfer Rules

When service members became eligible to transfer their Post-9/11 GI Bill benefits, they had to meet certain requirements.

New eligibility rules, passed in July 2018, changed who is eligible to transfer their GI Bill benefits. The following is now the DoD policy:

- Have at least six years of service on date of GI Bill transfer request, and you agree to serve four more years.

- Are eligible to serve an additional four years of military service.

- You have not yet completed your 16th year of military service (beginning Jan. 12, 2020).

The following members were previously allowed to transfer benefits but are no longer eligible under the July 2018 update to the DoD policies:

- No longer eligible: You have at least 10 years of service and cannot serve four more years because of policy or law, but you agree to serve as long as you are able by law or policy. Who can transfer benefits? Service members must now be eligible to extend four years in order to transfer their benefits.

- No longer eligible: You are retirement eligible from Aug. 1, 2009, through Aug. 1, 2012. (The service member must sign up for one more year of service starting from the date the GI Bill benefits are transferred). Who can transfer benefits? Service members must now be eligible to extend four years in order to transfer their benefits. Starting Jan. 12, 2020, members must not have completed their 16th year of service in order to transfer benefits.

Important note: All transfer requests must be submitted and approved while the member is still in the military. Transfers cannot be initiated after retirement or separation.

Eligible GI Bill Benefits Recipients:

Dependents must be in the DEERS System. The following dependents are eligible:

- Spouses, who are eligible to use the GI Bill benefit immediately or up to 15 years after the member separates from the armed forces. Spouses are not eligible to receive the monthly housing allowance (MHA) or book stipend while the service member is on active duty (BAH covers the MHA).

- Children, who are eligible to use the benefit after the service member completes at least 10 years of service, provided they have earned a high school diploma or equivalent or reached age 18. Children are eligible to receive the MHA and book stipend if their sponsor is still on active duty.

The Housing Allowance for Children is Under Fire

The monthly housing allowance is generous. It pays the same rate as the BAH for E-5 with dependents. Depending on where you live, this can range from around $700 to $3,000 per month. In some cases, the BAH rate is substantially higher than the cost of room and board through local universities. The MHA is intended to give veterans a decent standard of living while attending school. But the benefit also transfers to dependents.

Legislation has been proposed that will cut the MHA by 50% for future Post-9/11 GI Bill transfers to children. This change will not apply to those who have already transferred benefits. Additionally, members will have up to 180 days after the bill passes to be eligible for the current system. This change will only affect the housing allowance, not the amount of the GI Bill benefit itself.

Spouses will continue to receive the full MHA rate going forward.

New legislation passed during the coronavirus pandemic protected GI Bill benefits and maintained MHA payments through 2020 for GI Bill students who had to take classes at home because of lockdowns.

Transfer Benefits Now: You Have Nothing to Lose

The best part about transferring benefits (other than blessing your dependents with a free education) is that the transfer is non-binding. You can transfer your benefits to your dependents today, then later decide to decrease or even rescind those benefits.

When you transfer benefits, you can transfer a minimum of one month to each eligible dependent (the dependent must be in the DEERS system to be eligible to receive transferred GI Bill benefits). You can later change your allocation of benefits at any time.

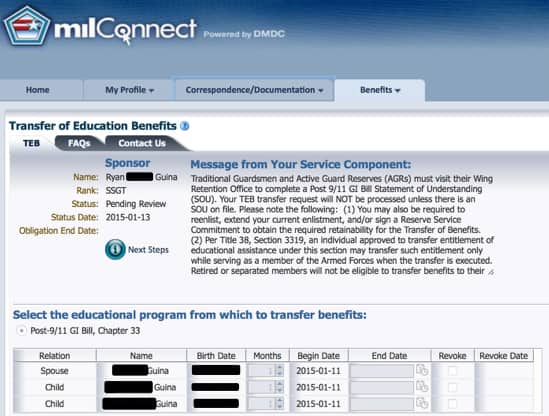

Simply log in to your MilConnect account, and update the number of months you are transferring to each individual (up to the maximum allowed). This can be found under:

- MilConnect Home –> Benefits –> Transfer of Education Benefits

I strongly recommend anyone eligible to transfer benefits do so.

Visit MilConnect to Transfer Your Post-9/11 GI Bill Benefits.

More discussion around this topic:

- MOAA – GI Bill Housing Benefit Cut.

- Paycheck Chronicles – Why I’m Not Angry About GI Bill Changes.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Lt Lee says

If a servicemember is separated for medical reasons and is not able to fulfill their entire four year service obligation, do they still retain the ability to transfer their benefits? Thanks!