The Defense Health Agency (DHA) manages the TRICARE health program for military members, retirees, and eligible family members. TRICARE West specifically administers services for the western United States region, and understanding what it is and how it operates is essential to access benefits.

Here’s what you need to know.

What is TRICARE West?

TRICARE is the healthcare program that serves active duty members of the U.S. military, retirees, and their family members. Eligible parties can receive healthcare at facilities operated by the military, and when they need care from non-military providers, TRICARE functions as their health insurance.

In the Western United States, Health Net Federal Services is the TRICARE program administrator, referred to as HNFS, TRICARE West, or Health Net TRICARE.

The TRICARE West Region includes the states of:

- Alaska

- Arizona

- California

- Colorado

- Hawaii

- Idaho

- Iowa (except the Rock Island Arsenal area)

- Kansas

- Minnesota

- Missouri (except the St. Louis area)

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oregon

- South Dakota

- Texas (Amarillo, Lubbock and El Paso areas only)

- Utah

- Washington

- Wyoming

The DHA contracts with TriWest to manage parts of TRICARE West. TriWest also manages the Department of Veterans Affairs Community Care Network in the western United States and Hawaii.

Eligible parties can enroll in different programs in TRICARE West:

TRICARE Select is available to TRICARE-eligible beneficiaries who are not able to or choose not to enroll in a TRICARE Prime option. With TRICARE Select, you manage your health care and can seek care from any TRICARE-authorized provider you choose.

TRICARE Prime requires you to enroll and may be subject to enrollment fees. Other premium-based health plans are also available for purchase if you qualify. These plans include TRICARE Reserve Select, TRICARE Retired Reserve, and TRICARE Young Adult.

The TRICARE Overseas Program (TOP) differs from and should not be confused with the TRICARE Select or TRICARE Prime in the United States.

Eligibility for TRICARE West

Eligibility for TRICARE Select and TRICARE Prime includes the following groups:

- Active duty family members (ADFMs)

- Family members of the National Guard and Reserve members who are called or ordered to active

- Service for more than 30 consecutive days

- Retired service members

- Family members of retired service members and their survivors

- ADFMs, retired service members, and family members of retired service members who have

- Medicare Part B, but are not yet eligible for Part A

- Other specific groups, such as some former spouses and Medal of Honor recipients

TRICARE Reserve Select is available for purchase by qualified members of the Selected Reserve of the Ready Reserve, their family members, and qualified survivors.

TRICARE Young Adult is available for purchase by qualified dependents until reaching 26.

Go here for more information on beneficiary eligibility.

TRICARE West Benefits and Coverage

TRICARE West provides medical, dental, vision, and mental health services. Prescription drugs, reproductive health services, and coverage for special needs are also covered.

These special needs are applied behavior analysis, cancer clinical trials, durable medical equipment, home health care, hospice care, and skilled nursing facility care.

TRICARE also covers medically necessary services. To be medically necessary means it is appropriate, reasonable, adequate for your condition, and considered proven.

There are special rules or limits on certain services, and some services are excluded.

The list of covered services changes from time to time, and it’s best to see the most current coverage by visiting the TRICARE West web page that details all available benefits

Cost of TRICARE West

Premiums, deductibles, and copayments will vary for military members, veterans, and others depending on what coverage you select and whether you use a network provider or an out-of-network provider.

The most important thing to note is that active duty service members do not have out-of-pocket costs for care.

Copayments and cost-shares are subject to change at the beginning of each calendar year. Cost-shares are a percentage of the contracted rate for network providers and the maximum TRICARE allowable for non-network providers on certain types of services.

Beneficiaries have an out-of-pocket maximum for covered medical expenses known as the catastrophic cap.

Detailed information on copayments and cost-shares is listed below by benefit, or you can view this information on the TRICARE Benefits A-Z list.

Outpatient Services Costs

- Ambulance Services

- Ambulatory Surgery (same day)

- Ancillary Services

- Durable Medical Equipment

- Emergency Room

- Home Health Care

- Hospice Care

- Laboratory and X-Rays

- Maternity Care

- Office Visits

- Preventive Services

- Urgent Care

Pharmacy Costs

Inpatient Services Costs

- Ambulance Services

- Hospitalization

- Maternity Care

- Newborn Care (after delivery)

- Skilled Nursing Facility

Mental Health Costs

- Hospitalization for Mental Health Services and Substance Use Disorder Treatment

- Partial Hospitalization Program

- Psychotherapy, Family Therapy, and Outpatient Substance Use Disorder Treatment

- Residential Treatment Center

Finding a TRICARE West Provider

Using TRICARE Select, you may receive care from any TRICARE-authorized provider without a referral. However, some services require prior authorization.

Providers must be authorized under TRICARE regulations and have their status certified by the regional contractors to provide services to TRICARE beneficiaries. TRICARE network providers agree to accept a negotiated rate as the full fee for services, file claims, and handle the paperwork for you.

Military hospitals and clinics provide medical and dental care to eligible individuals, including members of the uniformed services and their eligible family members. Military hospitals and clinics are usually located on or near military installations.

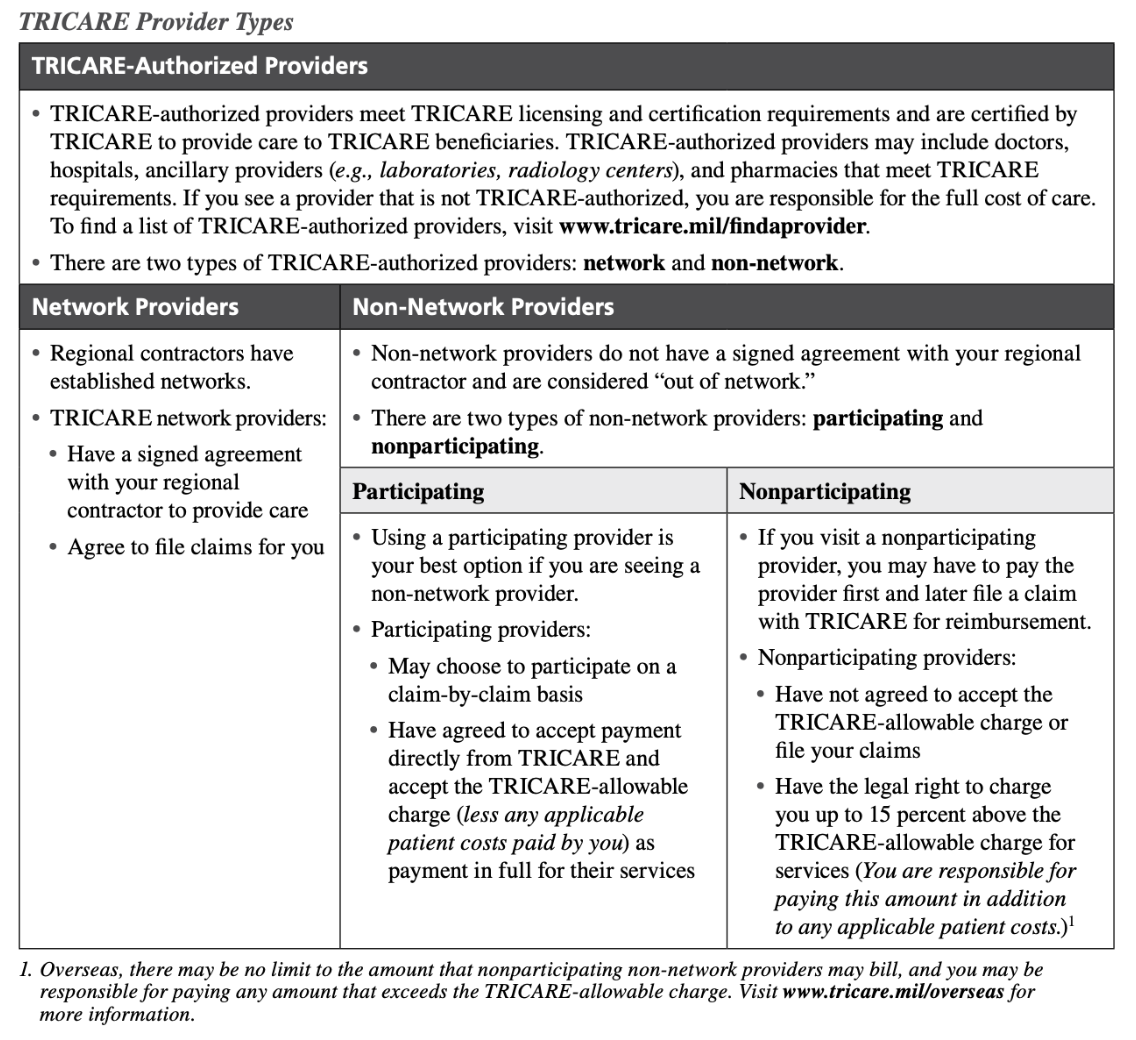

This chart will further explain the differences between in-network and out-of-network providers.

You can also find a comprehensive list of in-network providers for active service members here.

In addition, you can also find a comprehensive list of in-network providers for veterans here.

TRICARE West Region beneficiaries have options for remote care with Tele-Health providers. Referral requirements for telehealth are the same as those for in-person visits.

Active duty service members must obtain a referral before receiving urgent care or mental health care services.

NOTE: Always contact the provider’s office first to verify their current participation status.

Using TRICARE West Overseas

The TRICARE Overseas Program (TOP) is separate from TRICARE. You can get more information here or call the following numbers based on where you’re stationed:

- TRICARE Eurasia-Africa: 1-877-678-1207

- TRICARE Latin America and Canada: 1-877-451-8659

- TRICARE Pacific: 1-877-678-1208 (Singapore) 1-877-678-1209 (Sydney)

If you need emergency care while traveling overseas, go to the nearest emergency care facility or call the Medical Assistance number for the overseas area where you are traveling. If you are admitted, contact the TOP Regional Call Center before leaving the facility, preferably within 24 hours or on the next business day, to coordinate authorization, continued care, and payment.

TRICARE nonparticipating non-network providers may charge up to 15% above the TRICARE-allowable amount in the United States and U.S. territories. However, there may be no limit to the amount that nonparticipating non-network providers overseas may bill, and you are responsible for paying any amount that exceeds the TRICARE-allowable charge.

You can use any TRICARE pharmacy option when traveling, but be sure your DEERS information is current. To fill a prescription, you need a valid uniformed services ID card.

How to Make The Most of Your TRICARE West Coverage

Here are some important things to remember when using your TRICARE West coverage:

When an active duty sponsor retires, they will experience a “change in status.” When the sponsor’s status is updated in DEERS, they will receive a new uniformed services ID card showing the new “retired” status.

When a status changes to a family member of a retired service member, the TRICARE Select cost-shares and catastrophic cap will increase.

TRICARE defines an emergency as a serious medical condition that the average person would consider a threat to life, limb, sight, or safety. Call 911 or go to the nearest emergency room if a medical emergency occurs.

If you are admitted, you may need authorization depending on the type of care.

Most dental emergencies, such as going to an emergency room for a severe toothache, are not covered under TRICARE.

Schedule an appointment with a TRICARE network or TRICARE-authorized non-network provider for routine physicals, ongoing treatment for a chronic condition, visits to a specialist, or covered preventive care.

Avoid using the emergency room for nonemergency situations, which can result in longer wait times and higher costs. You can often be treated more quickly by a military hospital or clinic, a family doctor, or an urgent care center.

Visit the TRICARE-authorized provider of your choice when you need care. Referrals are not required, but some services require prior authorization.

Some providers may contact the regional contractor to obtain prior authorization for you.

Examples of services requiring prior authorization include:

- Adjunctive dental services

- Extended Care Health Option services

- Home health services

- Hospice care

- Nonemergency inpatient admissions for substance use disorders or behavioral health care

- Outpatient behavioral health care visits to an authorized provider beginning with the ninth visit per fiscal year (October 1–September 30) for a medically diagnosed and covered condition

- Transplants (all solid organs and stem cells)

This list is not all-inclusive. Each regional contractor has additional prior authorization requirements.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.