When you’re living paycheck to paycheck, waiting for your next direct deposit can feel like an eternity. By the thirteenth day of the cycle, you’re scraping the last bit of peanut butter out of the jar, diluting your shampoo with water, and praying you don’t have a minor emergency like a flat tire or a broken washing machine.

However, emergencies occasionally happen, and when they do, what options do you have?

You can rack up more debt on your credit cards, cover your eyes and let your bank account go into overdraft, or… you can check out a unique app called Brigit.

Let’s check it out in our Brigit review.

What Is Brigit?

Brigit is a financial wellness app that can tide you over until your next payday.

Instead, you can think of Brigit as a safety net that can help end costly overdrafts and keep your bank account balance in the positive.

More than 100 million Americans are living paycheck to paycheck – and many of them are either active duty or veterans. Nearly 30 percent of U.S. adults have no kind of emergency fund.

Banks and loan providers are making a killing on these hardworking people’s financial vulnerability. Payday loans can carry an average APR of up to an astronomical 400 percent. And overdraft fees can add up quickly.

In 2017 alone, banks made $34 billion off Americans who were waiting for their next paycheck. That’s ridiculous.

And that’s the problem Brigit was created to solve.

How Does Brigit Work?

Signing up for Brigit is easy and free.

When you apply for any sort of loan, you can expect a hard inquiry on your credit report that can lower your score.

That’s not the case with Brigit. There’s no credit check required, so there will be no effect on your credit score or report.

When you sign up for Brigit, you can connect one bank account to the app. Brigit then scans your transactions to view your recent income and expense history. If you apply for a cash advance, Brigit will take you through a quick approval process (this takes about 90 seconds). If you’re approved, you can request money right away.

Requests for funds submitted before 11:00 a.m. Eastern on a business day will arrive in your account by 11:59 p.m. local time on the same day. Fund requests made after 11:00 a.m. Eastern will arrive on the following business day.

If you have a verified debit card, you may qualify for Express Delivery, which will put the funds in your account within 20 minutes of your request for free. Note that this feature is still rolling out across Brigit accounts, so you may not be able to access this feature right away.

Each Brigit deposit will be for up to $250. The exact amount you receive will be determined by your needs and ability to comfortably repay without falling into a vicious debt cycle. You can repay the money once you receive your next paycheck.

Visit the Brigit Website To Learn More

What If You Can’t Pay Brigit Back Right Away?

If you have additional unexpected expenses and are unable to make your scheduled payment, Brigit even offers free payment extensions directly within the app. This gives users a little more flexibility with their repayment options.

After you’ve paid Brigit back, you can request more money when you need it.

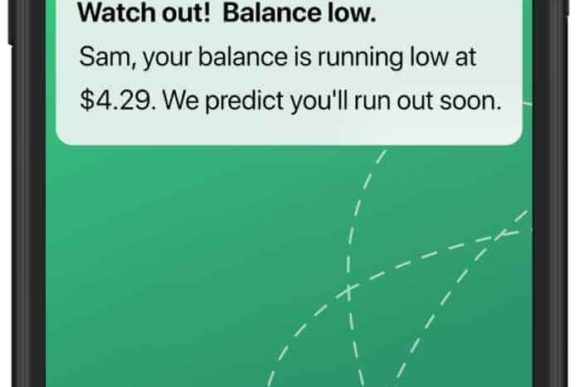

But Brigit will also work overtime for you by constantly analyzing your account. If the app predicts you’ll run out of money before your next paycheck, you can set up your account so that Brigit will send you a deposit automatically. So you can rest assured that the company is always waiting with a safety net.

How Much Does Brigit Cost?

Since there’s no interest charged on a Brigit account, how does the company make its money?

Instead of charging exorbitant interest, Brigit charges a small monthly account fee of $9.99 – cheaper than Netflix! What’s more, you will never, ever see another fee or hidden charge.

Let’s compare that $9.99 monthly fee to the alternatives. If you were to receive a payday loan for $250 at the average APR of 391 percent, in two weeks, you’d owe $268.80. That’s more than $18 just practically thrown away. And if you don’t pay it off in two weeks, the amount of interest owed will keep growing.

On the other hand, if you were to let your account overdraft, you’d have to pay a fee of as much as $40 per transaction. If your bank extends you money to cover the overdraft, you’ll also need to pay daily interest well north of 20 percent.

That $9.99 sounds a whole lot more doable. The best part is that you can turn the service on and off as needed. So you don’t have to sign up for the premium service right away. Instead, you can download the free app, and upgrade to their paid service if you ever need to tap into an advance on your paycheck.

Visit the Brigit Website To Learn More

Who Can Qualify for Brigit?

Brigit is great for military families because, in order to qualify, you just need a U.S.-based bank account and regular income.

The company doesn’t care if you have terrible or excellent credit. That’s never taken into account.

Military members with poor or no credit have been targeted by predatory loan companies. This is despite the Military Lending Act of 2006, which limited APRs for loans to military members to 36 percent. But even as a maximum, that 36 percent is shockingly high.

With Brigit, you won’t have to worry about getting ripped off, no matter your credit score.

Brigit Review: The Bottom Line

Brigit could be a good fit for service members, veterans, and anyone who lives paycheck to paycheck and finds themselves in a financial bind. Although $250 might not sound like a whole lot of money, it could help you squeak by with bills and groceries until your next payday.

In addition, the $250 maximum means members will be unlikely to abuse Brigit for unnecessary purposes. You’re not going to run out and get Jet Skis on a whim with that kind of money. Instead, Brigit should be used to help you and your family improve your financial health.

(If you’re experiencing greater financial need, here are some resources that can help.)

Sign up for a free Brigit account today for your financial peace of mind. It could save you a ton of money on interest and overdraft fees.

Sign up for a Free Brigit Account

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.