Are you considering leaving active duty for the National Guard or Reserves? This article compares each type of retirement at the rank of E-7. Follow these steps and substitute your anticipated retirement rank to see how retirement compares between active duty and the Reserve Component.

Note: This article uses the E-7 pay grade and 2016 pay scales. However, the examples work the same using any pay grade and pay tables from any year. Just follow the steps and plug in your pay grade and current or anticipated pay to understand how to compare active duty retirement pay and Reserve Component retirement pay for the same pay grades.

Is reserve retirement the same as active duty service retirement

In several ways “yes” but there are also some significant differences you should know as well.

Reserve retirement uses the same broad principles as the Active Duty system, but instead of basing retirement pay on years of service, Reserve retirement is determined using Retirement Points. A qualifying year is a complete year in which a Soldier has earned a minimum of 50 retirement points.

Members who accumulate 20 or more years of qualifying service are eligible for reserve retirement when they reach age 60. In some cases, retirees may qualify at a younger age.

These are Final Pay Plan and High-36 Month Average Plan are the two non-disability retirement plans currently in effect for qualified reservists.

The Final Pay Plan uses a multiplier percentage that is 2.5% times the years of creditable service. The creditable years of service is determined by the sum of all accumulated reserve points divided by 360. The High-36 retirement plan is the total amount of monthly basic pay the member was entitled to during the member’s high-36 months divided by 36.

By contrast, active duty retirement is calculated using the REDUX Plan (available only to active duty members who entered service on or after August 1, 1986), the Final Pay Plan or the High-36 Month Average Plan. Active duty members must also have a minimum of 20 years of creditable service but the big difference is that they can apply for retirement at the end of their career instead of waiting until age 60.

How do I calculate my military retirement pay? What is the average Reserve retirement pay?

The Department of Defense uses a multi-step formula to compute retirement pay, so there is no definitive answer when it comes to what the average Reserve retirement pay is.

A better way to address this question is to look closer at what those steps are and then use your circumstances to come up with a dollar amount that is applicable to you.

The Retired Pay Formula is determined by multiplying your retired pay base by a service percentage:

Retired Pay Base x Service Percent Multiplier = Gross Retired Pay

Gross retired pay is rounded down to the nearest dollar.

Each year of active duty service is worth 2.5% toward your service percent multiplier. So the longer you stay on active duty, the higher your retirement pay. For example, a retiree with 20 years of service would receive 50% of their base pay (20 years x 2.5%).

A retired reserve member converts points to active service equivalents by dividing those points by 360. For example, 7200 retirement points divided by 360 = 20 years of active duty service (2.5% x 20 years = 50%).

For disability retirements, you would receive 2.5% for each year of service, or a disability percentage assigned by the service at the time you retire. In either case, the multiplier is limited to 75 percent by law.

Examples of E7 Retirement Pay

Consider two 18-year-olds who join the military on the same day.

The first stays on active duty for 20 full years to retire as an E-7. They’ll base their pension on 2.5% x 20 years = 50% of their High-Three retirement system. Under the current High-Three* rules, their pension would be 50% of the average of the highest 36 months of base pay.

The second 18-year-old serves eight years on active duty while advancing to the E-6 pay grade, and then separates for a Reserve billet. Over the next 12 years as a drilling Reservist, they complete their “weekend a month, two weeks a year” of drills and active duty, while also mobilizing for two separate year-long deployments.

They get promoted to E-7 at about the same career point as their active-duty counterpart. Upon reaching 20 years of total service (eight years of active duty plus 12 “good years”) they request retirement awaiting pay.

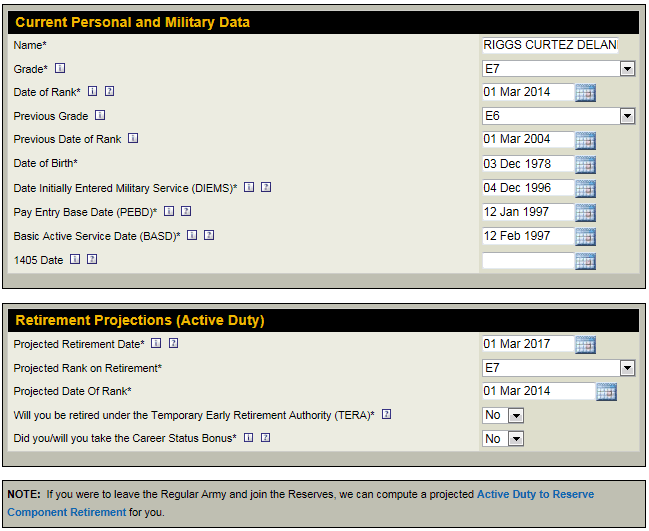

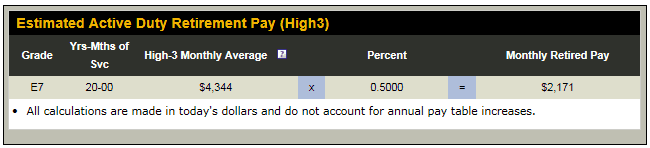

Both E-7s are the same age, the same rank, and subject to the High-Three rules. However, the active-duty E-7 retires and immediately starts drawing a pension. If they retired in 2016 then this calculator sets their pension at $2,171.00/month or $26,052.00/year.

My Army Benefits provides a calculator to calculate retired pay. The tool is easy to use and produces accurate results.

Their pension includes annual cost-of-living adjustments that are roughly equivalent to the Consumer Price Index, the government’s official measurement of inflation. These COLAs will continue for as long as they (and their survivors, if they chose a survivor benefit plan) draw their pension.

How To Calculate An E7 Reserve Points

When the second service member joined the Reserves, their active-duty time was credited to their Reserve point count at the rate of one point for each day. Each year-long mobilization would earn at least another 365 points.

By serving “a weekend a month, two weeks a year” over their other 10 “good years”, they can conservatively be expected to average another 75 points each year. These are average numbers, some Reservists will earn more points, some will earn less.

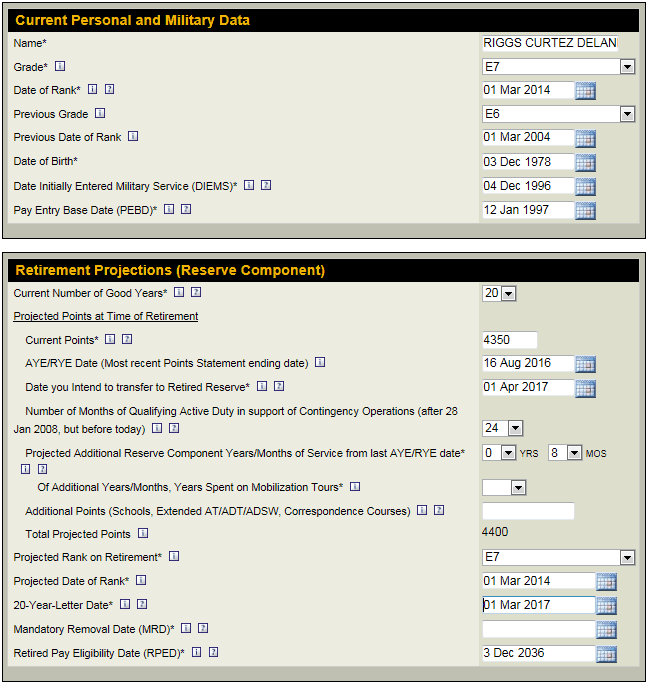

At retirement, the Reservist would have a point count of eight years of active duty, 10 years of drills, and two one-year mobilization periods.

Their total would be at least, 8×365 + 10×75 + 2×365 = 4400 points.

- 8 x 365 (Active Duty) = 2,920

- 10 x 75 (Drills) = 750

- 2 x 365 (Deployments) = 730

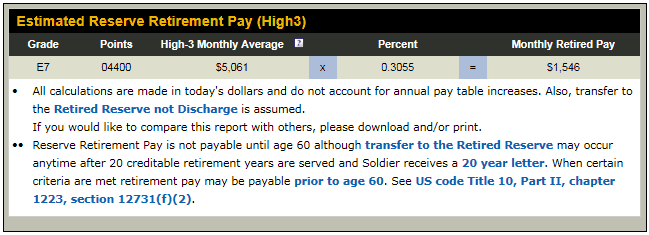

If they retired in 2016, this calculator sets their pension at $1,546.00/month or $18,552.00/year. Of course, pay wouldn’t begin until age 60.

The current instruction convert points to equivalent years by dividing into 360 (not 365). The percentage earned toward a Reserve pension would be 2.5% times the point count divided by 360, or 30.5%.

Although they were mobilized for two of their 12 years in the Reserves, at this point the Reserve E-7’s pension eligibility is only about 60% (30.5%/50%) of the active-duty E-7’s pension.

Click here to learn how to calculate a reserve retirement.

The Reservist’s pension also doesn’t start until they’re age 60– another 22 years. The good news is that because they “retired awaiting pay” instead of “resigning” from the Reserves, their pension will be calculated using the E-7 pay scale and maximum E-7 longevity in effect at age 60.

Pay Changes

It’s very difficult to predict how E-7 pay will change over the next 22 years, but it would be nice to have some numbers to refer to before making a decision to stay on active duty or to transfer to the Reserves. One pay assumption would be that it would keep pace with the civilian equivalent of their E-7 specialty.

In that case, the military’s E-7 base pay scale would rise by roughly the Employment Cost Index. Hopefully, in 22 years, Congress and the Department of Defense will agree that an E-7’s salary should have about the same purchasing power that it has today. In that case, the ECI would roughly keep pace with inflation and the Consumer Price Index.

The reality is that it’s impossible to confidently predict future pay scales, the ECI, the CPI, or pension COLAs. However, since the all-volunteer force began in 1973, the only proven way to retain servicemembers has been to keep military pay competitive with its civilian equivalent. (Otherwise, we wouldn’t have volunteered)!

Congress has attempted for several years to raise military pay at the same rate as the ECI (even greater for some ranks) and the pension COLA calculation closely tracks the CPI. Despite the uncertainties of predicting the next 22 years of pay raises and pension COLAs, it’s reasonable to assume that future E-7 pay will have roughly the same purchasing power as today’s pay.

While awaiting retirement pay for those 22 years, the Reservist will also be credited with the maximum longevity in that E-7 pay grade– 26 years– even though they only served for 20 years. In the 2016 military pay tables, the pay for E-7>26 is over 13% higher than E-7>20.

So although the Reservist’s pension eligibility only had about 60% of the equivalent active-duty pension when they retired awaiting pay, by the time they’re drawing that retired pay their longevity pay scale has risen another 13%.

The result is that by age 60 the amount of the Reserve E-7 pension has risen to nearly 70% ([30.5% x (1+13%)]/50%) of the active-duty E-7’s pension. If all of the pay assumptions are reasonably correct (and that’s a mighty significant “if”), then in today’s dollars they’d receive approximately $1850/month or $22,200/year.

Now that we’ve gone through the calculations the hard way, you could build your own spreadsheet to tinker with various ECIs and CPIs. Or you could try out your own assumptions with one of the pension calculators here.

Difference Between Active Duty & Reserve

The biggest difference between active-duty and Reserve pensions is that the active-duty E-7 immediately started drawing their pension at age 38 at 50% of their High-Three pay average in effect at retirement.

The Reserve E-7 would have also retired at age 38 but had to wait 22 years for their pension, calculated at the maximum longevity and pay table in effect during the year they turned 60.

If their pension at age 60 preserved its purchasing power at least as well as the active-duty E-7’s pension, then their first pension payment would be almost 70% of the active-duty E-7’s pension payment– even though the active-duty E-7 has been receiving a pension for over two decades.

When the 60-year-old Reserve E-7 finally starts drawing their pension, that income stream will continue to rise with the same annual COLA as the active-duty E-7’s pension. Their pensions will be one component of a retirement made up of tax-deferred accounts, taxable accounts, and any pensions from other (civilian or civil-service) careers.

The next post will show how to plan a retirement with multiple streams of income.

[*A couple of final notes for the expert reader: we could make this post a lot more complicated by having these E-7s choose the REDUX retirement plan, but I’m saving that analysis for a separate post. For now, let’s just say “Don’t do it.”]

[** This post assumes that the Reservist’s deployments did not make them eligible for an earlier retirement. Under current legislation, if those deployments had happened in 2008 or later then they may have been eligible to start receiving their pension as early as age 58. Learn more about early retirement from Guard or Reserves.]

Military Guide to Financial Independence

This book provides servicemembers, veterans, and their families with a critical roadmap for becoming financially independent. Topics include:

- Military pension

- TSP

- Tricare Health System

- & More

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Angel Santiago says

Hi, As a E-7 with 20yrs I only get $1030 for Army Reserve pay but this site says I should be getting more how can that get corrected?

Ryan Guina says

Angel, This article uses an example based on a hypothetical number of points. This is not a reflection of any specific career. Your retirement pay will be based on the number of points you earned, the payscale that was in effect at the time you retired, and other factors. You will need to work with DFAS or the Army Human Resources Command if you believe there is an error in your retirement pay. Best wishes!

Dave says

Hi Doug. Do you know anything about Federal civilian retirement, specifically the decision to buy-back military time, and for retirees; to waive their military pension? I volunteer with a federal employee organization that helps veterans, and I’m a Marine vet myself. We get so many questions, I’m trying to build up a “library” of resources.

Doug Nordman says

We do, Dave!

This post discusses how civil servants who are also Reserve and National Guard servicemembers can receive both their FERS pension and their Reserve pension:

https://the-military-guide.com/earning-military-pension-civil-service-pension/

These two posts from my friend (and fellow submarine vet) Eddie Wills explain how vets can buy their military service credit deposit, even if they’re receiving an active-duty pension:

http://gubmints.com/2013/03/26/gubmints-comprehensive-military-service-credit-deposit-guide/

http://gubmints.com/2013/04/15/military-service-credit-deposit-retired-from-active-duty/

It’s worth your time to read more of Eddie’s related posts for other civil-service tips.

If you really get into the weeds, here’s how Reserve/Guard members can estimate their Reserve pension and decide whether it’s worth it to keep drilling. (Spoiler: usually.)

https://the-military-guide.com/reserve-retirement-calculator/

https://the-military-guide.com/i-would-have-started-my-reserve-pension-by-now/

Frank Torres says

I am having a difficult time calculating my retirement payment amount. I served 3 years active duty, and later joined the active reserve. I was activated during desert shield and desert storm in theater for approximately 9 months. Later I was activated again for 9 months to participate in the peace keeping process in Kosovo.

Between active and reserve time I served my 20 years (I made the mistake of retiring after 20 as opposed to separate and stay as inactive reserve to collect more points and retire later). I retire as an E-7 with 20.

My question are: (1) Based on my time as reserve and active duty do I still have to wait to age 60 before being able to collect retirement pay? (2) Based on my 20 yrs of service as reserve, and rank what is approximately the amount of my monthly retirement? As I said I have been having difficult time stabling my pay with certainty.

Doug Nordman says

Great questions, Frank!

If you haven’t already done so, please read the post on calculating your Reserve pension:

https://the-military-guide.com/reserve-retirement-calculator/

I realize that you might not be old enough to collect the pension yet, but you should calculate it using the current DFAS military pay tables to be able to compare the amount of the pension (in today’s dollars) to your current expenses (in today’s dollars). Your future pension (at age 60) will have roughly the same purchasing power as today.

If you filed for “retired awaiting pay” after reaching your 20 good years, then your pension will be calculated using the future military pay tables in effect when you’re age 60, and at the E-7 longevity as if you’d been on active duty the entire time. In your case that’s probably the maximum E-7 pay. The post I’ve linked above takes you through the process of calculating your pension from your final point count and the assumption of “retired awaiting pay.”

If you reached 20 good years and filed for “discharge” or “separation” then your pension (at age 60) would be calculated using the pay tables in effect during the year you requested discharge/separation. Very few Reservists choose this option (I’ve only heard from one in a decade of blogging), but if you did then I can answer any additional questions you may have.

Starting your Reserve pension before age 60 is only applicable for mobilizations after 28 January 2008, and for some natural disasters and national emergencies after September 2014. Mobilizations for DESERT SHIELD, DESERT STORM, and Kosovo are not eligible unless they’re after those dates. From what you’ve written, it looks like you’ll start your Reserve pension at age 60.

Please add a comment if you have additional questions, or you could e-mail NordsNords at Gmail.

Elizabeth Burrows says

What if I joined active duty, went reserve for 5 years and finished my career active again. Would I have to do 25 years to immediately draw pension?

Doug Nordman says

Elizabeth, you’d qualify for a Reserve pension as soon as you had 20 good years (the five good years in the drilling Reserve plus 15 years of active duty). You’d qualify for an active-duty pension if you stayed to 20 years of active duty, or a total of 25 years in uniform.

https://the-military-guide.com/reserve-military-retirement-for-active-duty-veterans-with-previous-reserve-or-national-guard-service/

Roger Fairley says

Here how mine works out:

At 17 yrs old join AD Army for 6 yrs to 19 yrs of army reserves (pension $27,000) Plus 20 yrs as state law enforcement (pension. $32,000) at 44 yrs of age. Now I’m working a GS-10 job making $52k + $32k = $84k! This is not even including the fact I’ve done Part-Time substitute teacher gigs of $1100 a month for the past 20 yrs. Not too many retired enlisted AD personnel is this motivated… From the looks of things you can accomplish much more capital as a Weekend Warrior

Doug Nordman says

Thanks, Roger, great numbers!

Mike E-SixWithTwentytwoYears says

Two E-7’s, joined at 18 both with 20 years of Service, one with Active Duty retirement, one with a “reserve” retirement. The active duty guy gets 50% of his “high three” years or approximately 26,000/year, the Reservist gets nothing until age 60. Both die at 52…who wins then, the guy who could supplement his civilian pay by 26,000/year plus his MGIB, or the guy who never collected a dime of what he earned, and his MGIB eligibility expired at 10 years in the Reserves? Pay and points are proportional….just let the Reservist start collecting at the same time as his active counterpart. The amounts aren’t the same, but they both obtain instant benefit proportional to the amount of earned retirement under the current system.

Doug Nordman says

I appreciate the sentiments, Mike, but I doubt that type of Reserve retirement reform is on any legislative agenda… especially in a drawdown.

Rick Medeiros says

I did 10 years in the Navy and got out at 27 years old, went in the Navy at 17. Sure wish I had joined the reserves or maybe even did my 20. I’m 63 years old and have a miserable social security retirement that is very hard to live on.

Not only that I really miss that military life style, I had a freaking blast.

OS1 Rick Medeiros, USN

Doug Nordman says

Thanks, Rick, I get that comment from a lot of my “more experienced” readers!

Doug Nordman says

Carl, as near as I can tell Type 2 diabetes is not on the Camp Lejeune list.

Here’s the current list of Camp Lejeune conditions that the VA is awarding compensation for:

http://www.publichealth.va.gov/exposures/camp-lejeune/

Here’s the proposed expanded list:

https://www.va.gov/opa/pressrel/pressrelease.cfm?id=2743

I know of veterans receiving VA compensation for Type 2 diabetes, but it’s for exposure to Agent Orange in Vietnam. Here’s more info on the dates and locations:

http://www.publichealth.va.gov/exposures/agentorange/benefits/registry-exam.asp

carl says

Besides my illness with service connected , they denied my type 2 diabetes.i was station in camp lejune the same time they said the water was contaminated.is there any links for the type 2 diabetes with water contamination in camp lejune?

Doug Nordman says

Carl, I’m afraid your years of service do not qualify for a military pension. In almost all cases you have to serve for at least 20 years (active duty or Reserve/Guard “good years”). Servicemembers can also be retired early from active duty by a temporary program (like TERA) or for medical/physical disability that occurred while on active duty.

If your health issues are caused by a service-connected condition then you may be eligible for compensation from the Veterans Administration. If a veteran is severely disabled or has minimal assets then they may qualify for additional VA financial support. (https://www.benefits.va.gov/pension/) However that’s a separate program from the Department of Defense.

carl says

I served 2 years in the marines and 6 years in the army, i had been honorably discharged on both, .i developed a leg problem and started receiving disabiliy pension. I am now 60 years old. Am i still qualified to receive a retirement pension at the age of 60?

Doug Nordman says

Jan,

Although you must have more than enough good years (and a Notice of Eligibility letter) for a Reserve retirement, your active duty points alone do not qualify for an active-duty retirement.

Reservists and National Guard servicemembers can only claim sanctuary if they reach 18 years of points while mobilized on active-duty orders (not for training). They’re continued on active duty until they reach 20 years of service, and then they’re awarded an active-duty retirement based on 20 years. Reserve points are not counted when calculating an active-duty retirement. Here’s how sanctuary works, along with the instructions for each service:

https://the-military-guide.com/sanctuary-in-the-reserves-only-on-active-duty/

Unless you’ve met the requirements to claim sanctuary, your Reserve pension is calculated using all of your points:

https://the-military-guide.com/calculating-a-reserve-retirement/

Jan says

I have been a reservist for almost 36 years and have earned enough active duty for a 20 year active duty retirement. When calculating my active duty retirement, will my total retirement points be used for calculating my retired pay or will it be calculated using only the active duty points?

Michael says

I spent 9 years active Army and 11 years Navy Reserves. I deployed in Desert Storm, Had a break between services. I just retired this past November 2015. I never did a mobilization as a reservist. Does my retirement pay come any earlier than 60?

Doug Nordman says

Thanks, Michael, good question!

This is only for combat deployments as a Reserve or Guard member, and some Guard mobilizations for domestic responses such as natural disasters. The legislation also started on 28 January 2008. If you never did this as a Reservist, or did it before that date, then you’re not eligible for the earlier pension.

Bill says

I’m planning on retiring in 2019 with 9 years AD and 11 years as a reservist as an E7. Could you give me an estimate of my monthly income? I’m 50 years old.

Doug Nordman says

Thanks, Andrew, that topic causes a lot of confusion!

You can read more at these two posts:

https://the-military-guide.com/buying-your-military-service-credit-in-the-federal-civil-service/

https://the-military-guide.com/maximizing-your-civil-service-computation-date/

and use their links to contact Eddie Wills at Gubmints.com.

Jim says

Hi Doug, I found this article very eye opening. I am currently an O4 with 13 yrs and considering going ANG. I am unfortunately been passed over for O5 but may be promotable to O5 if I join ANG. I will supplement my income by going GS or work at the VA. A few questions:

1. Would I be financially ahead at age 60 with a high 3 O4 active duty retirement or a O5 ANG retirement?

2. Should I consider converting my AD credit into the GS/VA system?

Thanks!

Doug Nordman says

Jim,

Sounds like a great plan.

You could always hope to be continued on active duty as an O-4 until you reach 20 years of service (and an active-duty retirement). However you would have very little assignment flexibility and you might end up in hard-fill billets or unaccompanied tours of arduous duty. (I speak from personal experience.) It’s even possible that the drawdown would result in your involuntary separation that could also prevent you from joining the ANG.

If you leave active duty for the ANG before your next O-5 selection board, then you have a chance of selecting for O-5 in the ANG or (at the very least) being continued to 20 years of service as an O-4 (and an ANG retirement). There’s no guarantees here either, so you need to start talking to the ANG recruiter right now.

You’d have to compare the math on the two retirements. They’re both adjusted for inflation (‘real dollars’) so you could build a spreadsheet that starts the O-4 active-duty pension in seven years (perhaps at age 42) and the O-5 ANG pension in 25 years (at age 60). You’d use the O-4 High Three average for 20 years of service and the O-5 pay scales at the maximum longevity (>22 YOS). The O-4 active-duty pension would have a big head start (particularly if you invested the money or used it to pay off today’s debt) but in your 80s the O-5 pension would be gaining. In lifespan terms it’s probably a tie.

You absolutely should consider buying into a civil service pension with your active-duty time. I recommend you start with the GubMints.com guides:

http://gubmints.com/2013/03/26/gubmints-comprehensive-military-service-credit-deposit-guide/#.U2pbXoFdXh4 and

http://gubmints.com/2013/07/18/new-ebook-maximize-your-service-computation-date/#.U2pbYYFdXh4

While your veteran’s status would give you hiring preference for the civil service, there’s no guarantee that they’re actually hiring. Again you’d need to talk to your service’s transition counselors or the VA.

Keep in mind that you would have hiring preference for state or local governments as well, and you could also obtain military service credit with them. They may be just as accommodating of your ANG career as the federal civil service. You should also consider civilian employers who support the Guard & Reserve– talk to your local ANG recruiter for more information about them.

Please let us know what you decide to do and how it works out!

Andrew says

That service credit deposit thing really confuses me. help?

Doug Nordman says

Great question, and a very frequent one on this site!

Taks a look at this post:

https://the-military-guide.com/calculating-a-reserve-retirement/

It walks you through the process so that you can see where the numbers come from. Make sure that you’re getting credit for your good years, and let me know if any of your data seems missing.

Mike Ipsen says

Glad I got out after 4 years. The military ‘pension’ plan only gives you poverty wages after 20 years of service. Working for a private company my pension will be over 6 figures annually. Plus I never get shot at, a MUCH better deal if you ask me.

Doug Nordman says

Thanks for your comment, Mike!

I guess you’d have to look at the risk/reward options. On the reward side you’d have to compare the military pension’s vesting date & starting date (and its COLA) with the private company pension’s equivalents. Getting a pension from a private company also involves bankruptcy risk, as many airline pilots have learned over the years.

Not getting shot at: priceless!

Alan Smiley says

14yrs/20yrs = 0.70

$1,350mo/$1,957mo = 0.69

The reservist served 70% as much active duty time as the RA soldier and

ended up with a monthly pension that is 69% that of the RA soldier. Sounds pretty equitable to me.

The-Military-Guide says

Thanks, Alan, that might be more coincidence than correlation– but the symmetry is interesting.

Howell says

Lately I have been looking into how my military reserve retirement combined with my civilian pension will work in my retirement years. If by getting a handle on that number. I can decide to maybe change careers from the stressful hight paying job early and not take a huge hit since my reserve retirement will make up for those years I didn’t continue working my civilian job to max out on their retirment.

Doug Nordman says

Thanks for your comment!

Your Reserve pension at age 60 also means that you’ll need less pension income and savings from the rest of your assets after age 60. You’ll be able to spend some of those assets before age 60 to bridge the gap after you leave your job.