Before I joined the Air National Guard last year, I decided to transfer the funds from my Thrift Savings Plan account into an IRA. There are many pros and cons for deciding to transfer your funds to an IRA, so this is something you should look at from all angles before deciding to make the decision. A Thrift Savings Plan Rollover into an IRA can also be complicated, so get help from an investment professional if needed.

To start with, the TSP is actually one of the best retirement plans available due to the low expense ratios for the funds. I had previously kept my funds in the TSP because it gave me the option of transferring other IRAs or retirement funds into the TSP account at a later date. But as I was going to join the Air National Guard, it didn’t matter if I closed out my old account, since I could open a new TSP account once I joined the ANG.

The other reason I transferred my funds out of the TSP was to move my tax-exempt contributions out of the TSP and into a Roth IRA. The tax-exempt contributions were held in a Traditional TSP, and were made while I was deployed to a tax-free zone. Since those contributions were made with tax-free pay, they are eligible to be transferred into a Roth IRA – this has huge long-term tax benefits (see below for more information). But I had to liquidate the entire TSP account to access those funds.

First Step – Decide if Closing Your TSP Is Right for You

As I mentioned above, the TSP is a great retirement account due to the low expense ratios. There are also no added expenses or fees for keeping your Thrift Savings Account open, so if you don’t have a specific reason to close your account, you are probably better off leaving your TSP account open. Low fees and flexibility are important in investing.

Additionally, you are able to transfer external funds into your TSP account from other retirement plans, including 401k plans, other TSP accounts, IRAs, and similar plans. You just won’t be able to make new contributions if you are no longer serving in the military or working for the federal government. So keeping your TSP account open can be a good thing if you want to take advantage of the low expense ratios.

Here are some articles to help you make the decision:

- What to Do with Your TSP When You Leave the Government or Military Service.

- Should You Rollover Your TSP into an IRA?

As I mentioned above, in most cases, it makes sense to leave your account open unless you have a specific reason for moving the funds out.

You Decided to Roll Your Thrift Savings Plan into an IRA… Now What?

Once you make the decision to transfer your funds, you need to make sure you do everything in the right order to make sure the transfer or rollover goes smoothly*. Otherwise, you may find it takes too long to complete the transaction. This is important because the IRS could classify the transaction as a withdrawal if you don’t make the deposits quickly enough. This can include early withdrawal penalties (if under age 59.5), and paying taxes on the withdrawal amount. So be sure the enlist assistance if needed.

*Terminology note: The terms “Transfer” and “Rollover” are sometimes used interchangeably with retirement accounts. Transferring an account means the funds are transferred directly from one financial institution to another. A Rollover happens when the funds are sent to the investor, and the investor needs to deposit them into another qualified retirement account within a certain time frame, and according to IRS rules. This is important because it can have major tax implications if not done correctly.

Open an IRA Before You Start Any Other Paperwork

You need to open an IRA before you can transfer the funds from your TSP. You can request the Thrift Savings Plan write the check out to you, but it’s much faster and easier to directly transfer the funds to an IRA that has already been opened. This also reduces the likelihood of running into issues with the IRS.

You will need provide your bank or brokerage account and IRA account number when you make the funds transfer. If you already have an IRA, you can simply transfer the funds into your current account. If not, you will need to open a new IRA. Start by researching financial companies. We have a list of recommendations here, or you can go with any of the major military financial institutions (USAA, NFCU, PenFed) or major brokerage houses (Vanguard, Fidelity, Charles Schwaab, TD Ameritrade, etc.).

Make sure you have both a Traditional IRA and a Roth IRA if you have funds in both the Traditional and Roth sections of the Thrift Savings Plan, or if you want to send your tax-exempt contributions to a Roth IRA (see below for more information about this process).

Complete the Required TSP Paperwork

The next step is to start the paperwork from the Thrift Savings Plan. You can transfer some, or all, of your funds into an IRA. In fact, if you want to liquidate the majority of your TSP funds, but keep your account open, then leave at least $200 in your account, which is the minimum to remain open. You then maintain the flexibility of transferring funds into the account at a later date.

To make transfers or withdrawals you will need to download and fill out the required form:

- Form TSP-70 Request for Full Withdrawal (PDF)

- Form TSP-77 Request for Partial Withdrawal When Separated (PDF)

Then you need to complete the required sections.

Filling Out Form TSP-70 Request for Full Withdrawal. If you are doing a full withdrawal (transfer or rollover of the entire contents of your TSP), then you will need to fill out pages 1, 2, and 4 (Traditional Balance) and/or Page 5 (Roth Balance).

- Page 1 includes your personal information, and personal information for your spouse, if you are married. You will need to get your spouse to sign off on the transfer and get the signature notarized. This is a security feature to make sure both parties agree with the transfer. Many banks provide free notary services to members. Otherwise check your phone book or the Internet to find a notary public.

- In page 2, section 4, you declare how you want to take the withdrawal – as a single payment, life annuity, or monthly payments from the TSP. If you are transferring to an IRA, choose 100% for the Single Payment option. Of course, you can split this among different options if you choose. Select the Check Box in Section V to indicate you are transferring your assets to another retirement account. Section VII on page 2 requires your notarized signature to authorize the transfer.

- Finally, on Page 4 and Page 5 you indicate where you want the funds to be sent. You will need to include the address of your IRA custodian and the account number where you want the funds to be sent. You will then need your financial institution to fill out the remainder of page 4* or 5 (a verifying official needs to sign the form before the TSP will process it). Then your IRA custodian will fax or mail the completed form to the TSP.

- *See instructions below if you have tax-exempt contributions – this is important because your IRA custodian fills out this section. Instructions below.

- The Thrift Savings Plan will send a check directly to your custodian (for benefit of your account), and it should be deposited into your IRA.

Filling Out Form TSP-77 Request for Partial Withdrawal When Separated. This process is very similar to the above process, but the page numbers and sections numbers are different. Read through the directions very carefully to make sure you don’t miss anything. If you have questions, call your IRA custodian to walk you through the form. Even if they don’t transfer a lot of TSPs, they should be able to understand everything enough to be able to help you out. If they don’t, then look around for an IRA custodian with better customer service.

Transfer Traditional Funds to a Traditional IRA, Roth to a Roth IRA

It sounds basic, but you want to get this right the first time. When you are transferring your TSP funds, make sure you transfer them to the correct type of account. This will prevent problems with the IRS. Both the TSP-70 and TSP-77 have sections for both Traditional and Roth contributions and transfers.

If you want to convert a Traditional account to a Roth account, it’s best to do this in two separate transactions. Complete your TSP to IRA Rollover, then perform a Traditional IRA to Roth IRA rollover.

Be Careful with Tax-Exempt Contributions!

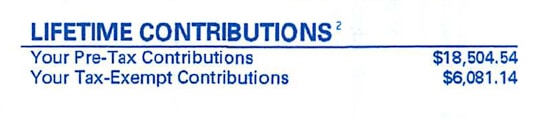

If you participated in the Traditional TSP when you were in a tax-free location, you most likely have tax-exempt contributions (this does not apply to the Roth TSP; it only applies to funds in your Traditional TSP account). To verify you have tax-exempt contributions, you should see something like this on your TSP statement:

You DO NOT want to transfer these funds into a Traditional IRA. These contributions are tax-exempt, so you are eligible to roll them into a Roth IRA. The long-term benefits of this are huge. Here is the difference:

- Contributions to Traditional IRAs, 401k plans and the TSP are considered pre-tax contributions, meaning you make the contribution before your income is taxed. This lowers your taxable income in the tax year you make the contribution. The funds then grow without taxes until you reach retirement age. The money is only taxed once you begin making withdrawals.

- Roth IRAs are the opposite. They are considered post-tax contributions. The funds are contributed after you have paid your taxes, then they grow tax free until you take withdraw the funds. You will never pay taxes on those funds again. The law allows military members to contribute tax-free income to a Roth IRA, meaning you will never have to pay taxes on that money – either the contributions, or the earnings.

In other words, the funds you transfer into a Traditional IRA will be taxed when you make withdrawals in retirement, but anything transferred into a Roth IRA will never be taxed again. Transferring the tax-exempt contributions into a Roth IRA gives you years of compounding growth without ever having to pay taxes on any of the gains. This is HUGE.

How to Transfer Your Tax-Exempt Contributions Correctly

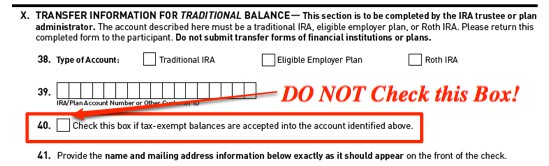

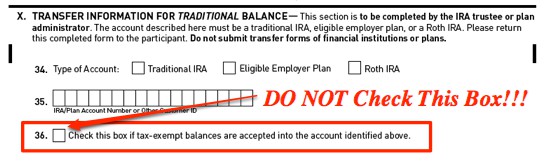

You can prevent your tax-exempt funds from being transferred into a Traditional IRA by NOT selecting the following Boxes in the forms:

Form TSP-70, Section X, Box 40. Do NOT Check this box!

Form TSP-77, Section X, Box 36. Do NOT Check this box!

Note: Section X is also the section that your IRA custodian fills out certifying you have an open account with them. When I transferred my TSP funds into an IRA, I sent a cover letter to my IRA custodian explaining my wish not to check Box 40 on Form TSP-70. I strongly suggest including written documentation to your custodian to ensure they do not check this box!

Tax-Exempt Funds are Sent to You as a Check – Be Careful with This! By not checking the box above, you are telling the Thrift Savings Plan that your custodian cannot accept tax-exempt contributions into your account. Thus, the TSP will disburse those funds in a check made out to you. This money is non-taxable, so technically, you can do anything you want with it, including cashing it and spending it. But that would be a long-term mistake since you can roll it directly into a Roth IRA and earn tax-free growth on your investments.

Once you receive the check, you will need to send it to your IRA custodian with instructions that it should be deposited into a Roth IRA. When I sent in my check, I signed the back and wrote the IRA account number on the back. I also included a letter stating that it was a Rollover from the Thrift Savings Plan. This is important information for the financial institution to note so they can code it correctly for the IRS. Failure to give them this information can cause problems down the road.

Understand the Tax Implications of Your Transfer

In most cases, there won’t be any issues if you transfer your funds directly from a Traditional TSP to a Traditional IRA, or from the Roth TSP into a Roth IRA. In both cases, the Thrift Savings Plan will issue you an IRS Form 1099-R at the end of the year (a 1099-R is issued for Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., pdf). This informs the IRS there was a distribution from your retirement account.

The company that receives the IRA will issue you an IRS Form 5498 (IRA Contribution Information, pdf). This is a tax form that shows the funds were deposited into another retirement account. These forms will prevent you from getting tagged with an early withdrawal penalty, taxes, or other nasty surprises.

If you do a Rollover, and not a Transfer, then you need to make sure the gaining institution codes the contributions correctly so you can avoid any problems with the IRS. You will still receive the IRS Form 5498 if you manually rollover your funds into an IRA vs. doing a direct transfer. Make sure to get some form of confirmation letter from your financial institution stating they received the funds and they were deposited into your IRA.

How Long Does a Transfer / Rollover Take?

As you might guess, this is variable, depending on how busy your IRA custodian is, how long it takes the TSP to process your paperwork, etc. That said, I’ve personally transferred two TSP accounts (one for myself, and one for my wife) and both were completed in less than 2 weeks. But it can take up to a month in some cases.

Obligatory Disclaimer: There are many factors to consider when transferring retirement accounts. Be sure you consider possible impacts on your tax situation, future retirement planning, etc. You may wish to consult a professional for more personalized and specific advice and recommendations.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

:uke says

Ryan, I know this article was posted some time ago. While I am still dealing with the shock of realizing that the growth on my tax-exempt contributions is actually -not- tax-exempt (despite a pie chart and table on the new TSP site saying it is), it would seem like things have gotten easier with the paperwork (but this is a question more than a statement).

As I go through the online instructions, it seems that I -would- check the box that my current employer accepts tax-exempt balances. It then asks you to which accounts do you want to send the tax-exempt balance (really the tax exempt contribution) and where you want to send the taxable balance.

My plan would be to transfer the tax exempt balance directly into my Roth IRA and the taxable balance into my qualified 401K plan with my current employer. (both managed by the same institution). No check to me. Just that tax exempt balance from my traditional TSP account directly into the Roth. You said a few times that you can contribute your tax-exempt amount directly into a Roth but then it sounded like you were saying you can’t do that. Just trying to get some clarification there. Thanks.

Steve Hopwood says

I hate TSP. A million different ways to contribute, but ABSOLUTELY ZERO ways to get your money out. TSP form 70? where is it located? Not on the TSP website. And why should I have to pay for the forms from a private website?